Here are the latest real estate market statistics from Macdonald Realty on listings and sales in April 2024.

Find all the infographics related to the April Market Statistics by visiting the Facebook Album.

Your South Surrey/ White Rock Expert

Here are the latest real estate market statistics from Macdonald Realty on listings and sales in April 2024.

Find all the infographics related to the April Market Statistics by visiting the Facebook Album.

The British Columbia government has introduced legislation enacting its new home-flipping tax on Wednesday.

The province says the tax will target speculators and improve housing supply.

“Wealthy investors are using housing as a short-term investment to make a fast profit while people looking for homes can’t get into the market,” Finance Minister Katrine Conroy told media after introducing the bill in the B.C. legislature.

Click the link below to view the monthly market statistics for your area in an easy to understand infographic. Listings, sales and prices are summarized for condos, townhomes and single-family homes in cities across BC. For more up-to-date market information please visit macrealty.com/blog.

April has arrived and the new month is filled with events that you’ll want to check out around Metro Vancouver!

Number of Metro Vancouver homes listed for sale up by 23% (DailyHive)

Metro Vancouver real estate deals slow to start in 2024 (BIV)

More options for home buyers, but real estate sales have yet to pick up (Times Colonist)

Relief on the way for South Okanagan’s tight industrial market (BIV)

B.C. rejects Prince George’s request to be exempt from upcoming short-term rental rules (CTV News)

B.C. to ban some ‘personal use’ evictions, stop rent increases over new children (Castanet)

Housing market will see ‘staggered’ return of buyers and inventory: RBC (Vancouver Sun)

Younger Canadians buying homes sooner than planned (CityNews Everywhere)

Look what’s happened to the cities with average $1-million home prices (The Globe and Mail)

Find all the infographics related to the February Market Statistics by visiting the Facebook Album.

Click to view market statistics for: Fraser Valley | Greater Vancouver | Okanagan | Vancouver Island | Whistler, Squamish and Sunshine Coast

The assessed value of properties in B.C. has stabilized on average, with some outliers such as Lytton, Haida Gwaii and Tumbler Ridge recording big jumps in worth.

According to statements released Tuesday by the B.C. Assessment Authority, property values as of July 1, 2023, changed on average between minus 10 per cent and plus five per cent.

Click the link below to view the monthly market statistics for your area in an easy to understand infographic. Listings, sales and prices are summarized for condos, townhomes and single-family homes in cities across BC. For more up-to-date market information please visit macrealty.com/blog

A brand-new month means new events to discover in Vancouver!

Fill your February with these 48 things to do around the city and beyond, including FAN EXPO Vancouver, Black History Month, and Valentine’s Day activities.

Vancouver home sales rise in January as demand outpaces newly listed properties (Toronto Star)

Greater Vancouver Real Estate Market Off To “Strong” Start In 2024 (Storeys)

Metro Vancouver ‘toughest’ rental market in Canada, says CMHC (Business in Vancouver)

Signs of stability in Fraser Valley housing market (Financial Post)

Real estate sales up from last year’s ‘very low numbers’ (Times Colonist)

Sales and prices up in Kamloops, Okanagan real estate markets (iNFOnews)

Spring real estate trends arrive early as number of home sales jump in January (Castanet)

British Columbia’s population to reach nearly 8 million by 2046: forecast (DailyHive)

Federal government extends foreign buyer ban on Canadian homes to 2027 (Vancouver Sun)

Metro Vancouver Presale Market Will Likely See ‘Marked Improvement’ In 2024 (Storeys)

SURREY, BC — High interest rates kept a lid on sales and listings in the Fraser Valley in 2023, while holding year-over-year price growth to low single digits.

The Fraser Valley region ended the year with 14,713 sales recorded on its Multiple Listing Service® (MLS®), a decline of four per cent over 2022 and 23 per cent below the 10-year average. New listings in the Fraser Valley were also at a 10-year low, at 29,610, eight per cent below the 10-year average.

The composite Benchmark home price in the Fraser Valley closed the year at $988,900, down six per cent from its 2023 peak in July, but up on the year by five per cent.

“Back-to-back mid-year interest rate hikes slowed the market despite strong sales and new listings in the spring,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This left the market in overall balance for the latter half of the year, albeit at low levels of activity. We anticipate 2024 will bring increased optimism on behalf of buyers and sellers as the Bank of Canada is expected to lower interest rates before mid-year.”

December 2023

For the month of December, the Board recorded 837 sales on its MLS®, a drop of six per cent from November, but 17 per cent higher than December 2022.

At 942, new listings dropped by 54 per cent in December, but increased 17 per cent compared to December of 2022. Total active listings for December stood at 4,670, a decrease of 25 per cent month-over-month, but 19 per cent higher year-over-year.

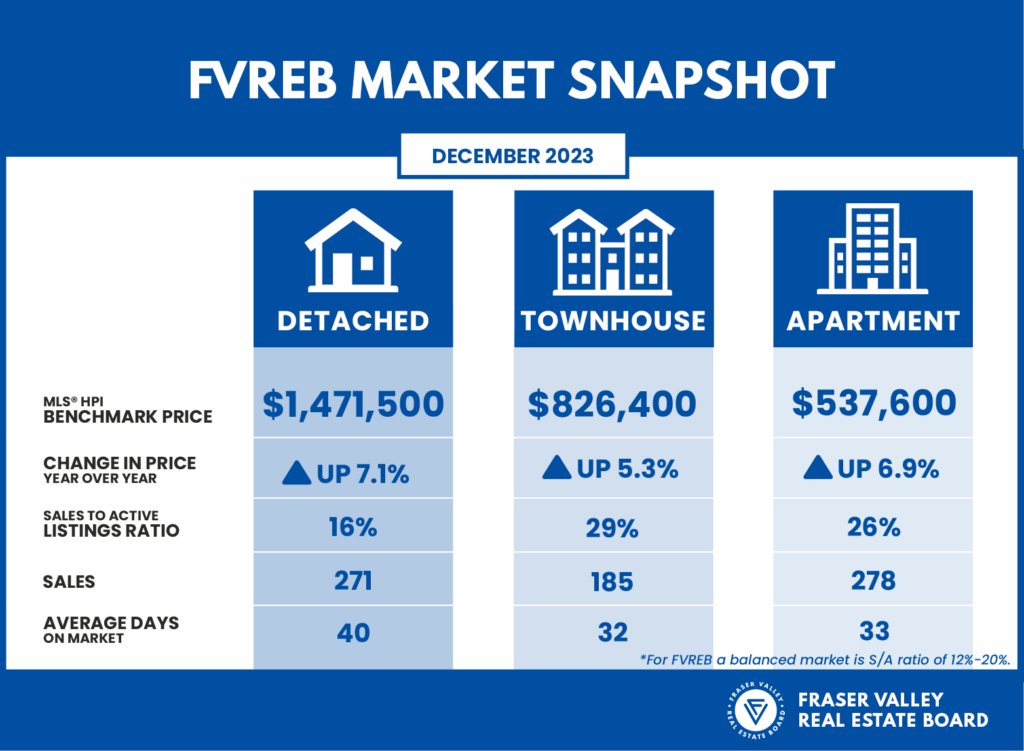

With a sales-to-active listings ratio of 18 per cent for December, the overall market closed out the year in balance. Detached houses closed out 2023 with a ratio of 16 per cent, while both townhomes and apartments remained in seller’s market territory at 29 and 26 per cent respectively. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“2023 saw buyers and sellers adjust to new rate realities, and the impact of those high rates were reflected in the low number of sales in the Fraser Valley,” said FVREB CEO Baldev Gill. “However, as rates start to ease, we expect market activity will pick up. This will create opportunities for buyers and sellers who are advised to consult with a professional REALTOR® before jumping into the market.”

On average, properties spent approximately 41 days on the market, with single family detached homes spending 40 days on the market. Townhomes and apartments moved more quickly at 32 and 33 days respectively.

Overall Benchmark prices continued to slide for the fifth month in a row, losing 1.5 per cent compared to November.

MLS® HPI Benchmark Price Activity